Bitcoin is on the verge of a historic transfer because it pushes towards its all-time highs, surging above the $71,000 mark simply yesterday. This breakout has ignited optimism amongst analysts, who count on additional upside within the coming weeks because the US election attracts close to—a interval traditionally marked by heightened volatility and market shifts.

Crucial knowledge from CryptoQuant signifies that Open Curiosity has reached $22.6 billion, with half of those positions held by bears. If Bitcoin continues to climb, this setup creates a excessive danger of brief liquidations, doubtlessly accelerating shopping for strain as costs push above $71,000.

Associated Studying

As momentum builds, the following few days will decide whether or not BTC can maintain its uptrend or if a consolidation section beneath the all-time excessive will proceed. Buyers are intently watching these worth ranges, as a confirmed breakout might sign new highs for Bitcoin. On the similar time, a stall would possibly recommend a necessity for added consolidation earlier than a bigger transfer.

Bitcoin Bears In Severe Bother

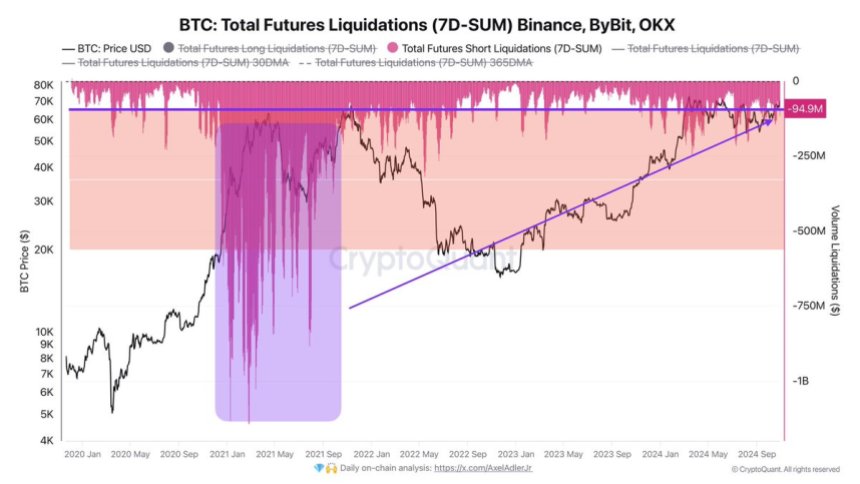

Bitcoin bears are actually at excessive danger of pressured liquidations as a big stage of brief place liquidity hovers above the $71,000 threshold. In keeping with high analyst and macro investor Axel Adler, this situation might ignite a robust rally if brief positions begin liquidating en masse. Creating momentum that propels BTC past its all-time highs. Adler shared a CryptoQuant chart on X, noting that Bitcoin Open Curiosity has surged to $22.6 billion, with half of those positions held by bears.

In his evaluation, Adler emphasizes that the present market construction is poised for a significant squeeze. “There’s no must hesitate in liquidating brief positions to drive the value up,” Adler states, suggesting {that a} cascade of liquidations above $71,000 might act as a launchpad for Bitcoin, taking it into uncharted worth discovery ranges. This course of, often known as a “brief squeeze,” happens when overleveraged brief holders are pressured to shut their positions, leading to giant purchase orders that ship costs even larger.

Associated Studying

If this situation unfolds, Bitcoin wouldn’t be the one one benefiting. As BTC leads the market, a rally previous earlier highs might sign a contemporary cycle for all the crypto area. Altcoins usually comply with Bitcoin’s lead, and the spillover impact might gasoline a complete bull run, with new highs throughout a number of belongings.

Buyers are watching intently, as such a transfer might renew curiosity and funding within the crypto market, drawing in retail and institutional capital. With BTC on the sting of worth discovery, the following few days could show pivotal in shaping the market’s route.

BTC Testing Cruial Provide

Bitcoin is testing a provide zone at $71,200, brushing up towards the final resistance stage earlier than reaching its all-time excessive. Bulls seem firmly in management, with worth motion signaling a probable breakout above this stage within the coming days. Breaking and holding above the $70,000 mark stays vital. This psychologically important stage reinforces bullish sentiment, encouraging extra consumers to enter the market.

Nevertheless, a brief retracement to collect liquidity at decrease demand ranges would profit Bitcoin’s uptrend. A dip towards the $69,000 stage, and even right down to $66,500, would nonetheless align with a bullish outlook. It might entice additional curiosity and create a more healthy base for the following rally. These areas would permit Bitcoin to collect liquidity earlier than making a stronger push towards new highs.

Associated Studying

Merchants are watching, realizing {that a} sustained transfer above $71,200 might pave the way in which for worth discovery past all-time highs. A profitable breakout might set off renewed momentum throughout the market, sparking a broader bull run as Bitcoin leads the cost.

Featured picture from Dall-E, chart from TradingView