Traders are defending towards a possible spike in crude costs. Palm oil futures are surging, and merchants are warming as much as exchange-traded funds for gold towards a backdrop of geopolitical uncertainty and interest-rate cuts.

Article content material

(Bloomberg) — Traders are defending towards a possible spike in crude costs. Palm oil futures are surging, and merchants are warming as much as exchange-traded funds for gold towards a backdrop of geopolitical uncertainty and interest-rate cuts.

Listed below are 5 notable charts to contemplate in world commodity markets because the week will get underway.

Oil Choices

Whereas the rally in oil futures has cooled a bit, shopping for of name choices to guard towards a worth spike has continued apace. The mixture open curiosity for Brent name choices — which profit when costs rise — rose to a document 2.19 million contracts as of Thursday. Traders proceed to be on edge amid uncertainty in regards to the battle within the Center East.

Commercial 2

Article content material

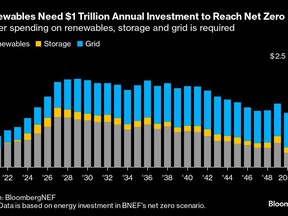

Renewables Spending

World spending on renewable power, battery storage and grid upgrades have to speed up past the document stage seen in 2023 to zero out greenhouse fuel emissions by 2050, in accordance with BloombergNEF. Renewables require a mean funding of $1 trillion per 12 months between 2024 and 2030 to achieve that focus on, in accordance with BNEF estimates. Over the identical time-frame, common investments in battery storage will have to be $193 billion a 12 months, whereas $607 billion will have to be spent yearly in grid upgrades. Governments want to finish fossil gasoline subsidies, take away rules and ease provide chains to allow clean-power builders to construct initiatives, BNEF stated.

Palm Oil

Tight provide in high producers Indonesia and Malaysia has pushed futures of palm oil — the world’s most generally consumed vegetable oil — to highs final seen in April. The timber that develop the commodity are ageing, and the rally has put the crop at an uncommon premium to its principal different, soybean oil, the place world harvests have been extra bountiful. Ought to an escalation of hostilities within the Center East disrupt commodities and power commerce, that might stand to additional increase the tropical oil, which can be used as a feedstock for biofuels.

Commercial 3

Article content material

Gold ETFs

Traders are warming as much as gold ETFs amid the steel’s greater than 25% surge this 12 months, due to its enchantment as a haven asset in occasions of geopolitical and financial uncertainty and its function as diversification play to safeguard wealth. World holdings of bodily backed gold funds have registered 5 straight months of positive aspects, reaching 3,200 tons by September, in accordance with information from the World Gold Council. Whereas buyers remained internet sellers of about 25 tons in gold ETFs year-to-date, robust inflows over the previous few months turned the year-to-date worth of the ETFs to optimistic to $389 million, in accordance with John Reade, market strategist at WGC. The valuable steel surpassed $2,600 an oz. to an all-time excessive final month, bolstered by the Federal Reserve’s shift to rate of interest cuts. Non-yielding gold tends to carry out higher in a low-rate surroundings.

Milton & Gasoline

Pure fuel futures slid within the lead-up to Hurricane Milton and in its aftermath as tens of millions misplaced electrical energy. Gasoline is used to energy the vegetation that create electrical energy for properties and companies, and when the lights exit, demand for fuel usually plummets. Futures have been down almost 8% week-over-week.

—With help from Megan Durisin.

Article content material