Generally your finest simply isn’t adequate. That’s the lesson Nvidia (NVDA) discovered Wednesday after the corporate’s inventory value fell 3% regardless of posting better-than-expected second quarter earnings and steering for the third quarter.

It’s not as if the corporate’s progress was unimpressive, both. Income jumped 122% 12 months over 12 months to $30 billion, up from $13.5 billion. Nvidia’s all-important knowledge heart income topped out at $26.3 billion, a 154% year-over-year enhance.

However that wasn’t the form of blowout that traders have rapidly grown accustomed to over the previous few quarters.

Past investor sentiment, Wall Road analysts have additionally seemingly caught on to Nvidia’s progress after a number of quarters of massive surprises to the upside.

Nvidia’s income reported Wednesday beat Wall Road expectations by 4.1%, the slimmest margin because the fourth quarter of its 2023 fiscal 12 months.

As Nvidia’s enterprise has boomed during the last two years, the corporate’s income topped Wall Road forecasts by double-digit share factors for 3 straight quarters, together with a 22% distinction in its fiscal second quarter of 2024.

And as Wall Road seems to have gotten a greater really feel for Nvidia’s progress at this level within the AI funding cycle, questions have additionally arisen in regards to the standing of Nvidia’s next-generation Blackwell chip.

Forward of the corporate’s earnings announcement, the Info reported that the chip, the follow-up to Nvidia’s Hopper line, confronted delays that might influence among the firm’s largest clients together with Microsoft and Google.

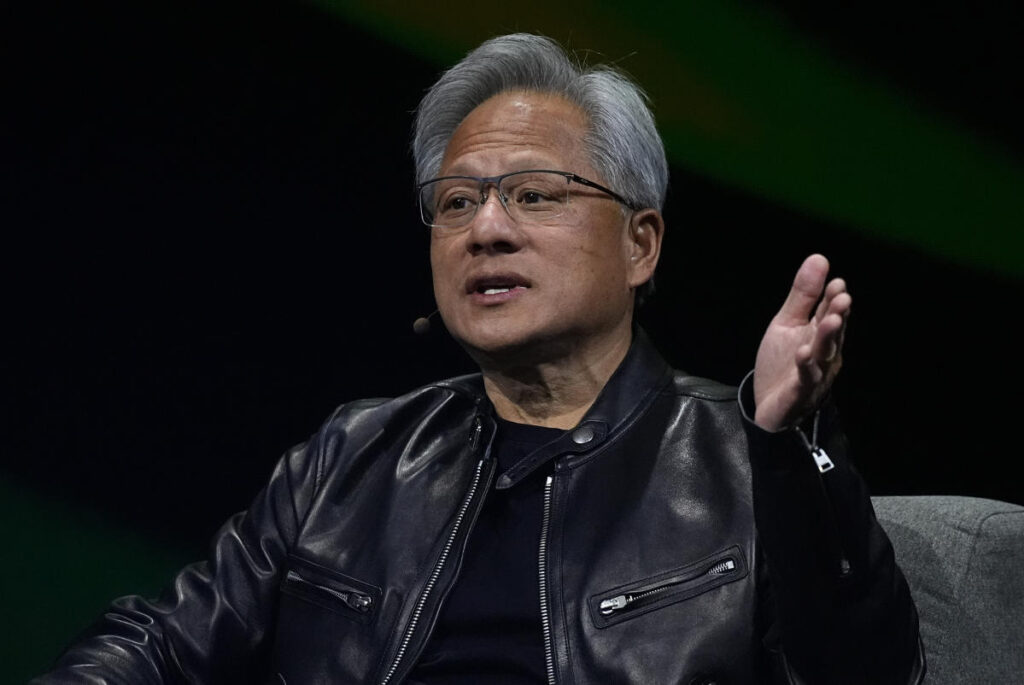

In her quarterly feedback, Nvidia CFO Colette Kress defined that the corporate made modifications to Blackwell to enhance its manufacturing yield. CEO Jensen Huang, in the meantime, stated that the chip is at present being sampled to clients, a significant step towards transport the processor at quantity.

Huang stated the corporate expects to ship a number of billion {dollars} of Blackwell income within the fourth quarter. However the CEO couldn’t pin down precisely how a lot income Blackwell would generate, regardless of analysts’ questions.

Huang, nevertheless, did present a lot of different sturdy factors for Nvidia, together with declaring that demand for Blackwell platforms is effectively above provide. The CEO additionally stated that Nvidia’s Hopper platform will proceed to develop within the second half of the 12 months, and defined that the corporate expects its knowledge heart enterprise to develop “fairly considerably subsequent 12 months.”

Huang additionally stated that AI inferencing is driving the corporate’s knowledge heart income. Inferencing refers to computer systems operating AI applications and offering customers with solutions to their queries.

That ought to put to relaxation fears of threats to Nvidia’s long-term progress as corporations pivot from coaching AI fashions to utilizing inference. Huang seems to imagine that Nvidia will proceed to plow ahead as clients use its chips to each practice and run their AI fashions.

Nvidia remains to be the world chief in AI chips, and it’ll be a while earlier than rivals AMD (AMD) and Intel (INTC) catch as much as its {hardware} and software program lead. And whereas Nvidia could also be going through a near-term decline in its inventory value, Wall Road remains to be on board.

In an investor word launched following Nvidia’s earnings, BofA’s Vivek Arya raised his value goal on the chip designer to $165 from $150 per share, writing, “Regardless of the quarterly noise, we proceed to imagine in [Nvidia’s] distinctive progress alternative, execution and dominant 80%+ share as generative AI deployments are nonetheless of their first 1-1.5 [years] of what’s no less than a 3 to 4-year upfront funding cycle.”

Raymond James’s Srini Pajjuri additionally raised the agency’s value goal on Nvidia’s inventory from $120 to $140, writing in an investor word that “Blackwell delays seem higher than feared and administration is forecasting a powerful ramp in FQ4.”

Pajjuri additionally stated demand for Nvidia’s current-generation Hopper chip continues to be wholesome and pointed to anticipated gross sales progress in This fall, regardless of Blackwell manufacturing ramping up on the identical time.

Morgan Stanley’s Joseph Moore, who raised his value goal for Nvidia from $144 to $150, referred to as out Nvidia’s sky-high expectations almost about the corporate’s inventory strikes after the earnings report.

“Expectations change into more difficult because the superlative turns into mundane, however this was nonetheless a really sturdy quarter given the transitional nature of the present surroundings.”

Whether or not that’s sufficient to fulfill traders subsequent quarter stays to be seen.

E mail Daniel Howley at dhowley@yahoofinance.com. Comply with him on Twitter at @DanielHowley.

Learn the most recent monetary and enterprise information from Yahoo Finance.